CHAPTER 2FINANCIAL GOALS

"MONEY CAN’T BUY HAPPINESS, BUT IT DOES PLAY A BIG ROLE IN HELPING YOU TO ACHIEVE WHAT’S MOST IMPORTANT TO YOU."

By figuring out what you need to make your personal goals a reality and setting specific financial goals to get you there, you’ll be on your way to enjoying those things in no time.

Once you understand your current financial health, the next step you need to take is to set long-term and short-term financial goals and achieve them step-by-step. That is also the definition of setting and fulfilling financial goals in accordance with your ability.

From an individual or a family’s financial perspective, one can have dozens of goals. In order to arrange and streamline personal financial goals, the following “3 key pillars” of personal finance should be followed:

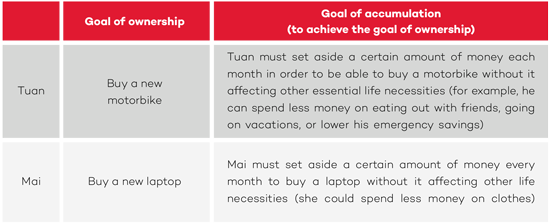

This is how it looks for Tuan and Mai:

• Own assets

• Accumulate assets

• Protect assets

Using these “3 pillars” helps us:

- Accurately assess the feasibility of the goals. If a goal is not realistic, it should be quickly adjusted or changed to avoid wasting time and placing unnecessary pressure on yourself.

- Analyze how to reach “achievable goals.”

- Always be proactive when it comes to income and expenses, so that short-term financial goals do not affect longer-term ones.