Effective spending management

It is believed that EARNING MONEY is inherently difficult and health-damaging, so it would be really sad if SPENDING MONEY also made you worried; at the very least, spending money should bring a sense of freedom and enjoyment. For many people, keeping a record of their daily expenses is unfeasible and impossible. Therefore, in this section, you’ll learn about a very traditional method but adjusted with new thinking to optimize and minimize spend management. This method is used by a number of professional personal financial advisors in the U.S., Australia, and Singapore for their customers.

First, you have to divide your income between 3 sources of expenses in the following order:

MONEY FOR INVESTMENT & SAVINGS

Read the Savings section of this chapter. Always remember that this should be set aside FIRST when you get your earnings.

MONEY FOR ENTERTAINMENT

This includes expenses for eating out, hosting a reception, shopping beyond basic needs, and traveling. This amount should account for about 10% of your income and should not exceed 15% of your monthly income (if your job requires you to socialize regularly, you should calculate using other criteria, separate from your personal entertainment needs).

You can control this amount further by ZONING, meaning you decide to cut out a specific amount and put it in a single account to manage. Any expenses for ENTERTAINMENT NEEDS should come from this account only. If you use a credit card to pay for something, you should immediately transfer the money from this account to the credit card so that all spending is controlled in a single account. The monthly balance from this source will form a fund for annual trips. By doing this, your family can feel confident when shopping and traveling. There is no need to remember, take notes, and importantly, you don’t have to worry about your spending since everything is in budget.

The remaining money is for ESSENTIAL NEEDS

STEP 1

Pay all monthly FIXED AMOUNTS (such as electricity, water, and Internet bills; tuition fees for children, insurance premiums, house rent; gifts for parents, English tuition fees, gym fees) and remember the total sum of these expenses. There is no need to remember each item in detail. Update this number whenever there is a change.

STEP 2

Estimate your monthly GROCERY SHOPPING bill. You also need to fix a number, for example VND 100,000 per day. Then, you’ll feel comfortable when spending within the fixed amount.

STEP 3

Fix an amount for odd expenses for each month (travel, haircut, coffee, etc.).

STEP 4

The remaining amount is for UNEXPECTED expenses such as online purchases and furniture, or unexpected health checks and treatments, funerals, and weddings. You should use a single account for these (to look up the statement when required).

STEP 5

If there is any money left over after all that, you should use it for either INVESTMENT & SAVINGS or ENTERTAINMENT NEEDS.

As mentioned earlier, none of this requires much knowledge of accounting or bookkeeping. The essence of what you are doing in this step is zoning expenses and budgeting to “feel comfortable” when spending within an approved budget. These 5 steps are particularly important for those who are married as it ensures each family member has pocket money and can cover their living expenses without depending on each other.

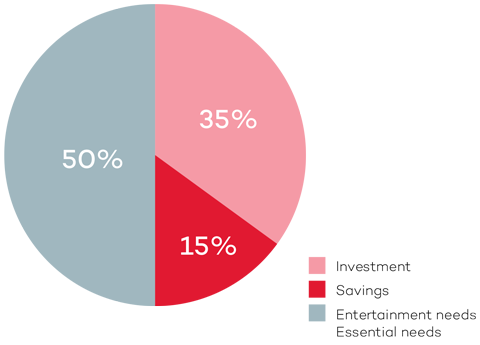

With an income of VND 25,000,000 per month and needs as shown in the table on page 19, Tuan will reset his spending into 3 parts as follows.

1. Investments - Savings (ideally 35%)

Tuan plans to buy a house in the next 10 years, so he needs to accumulate and invest from now on. Tuan will put 35% of his income into an accumulation and investment fund as soon as he receives his paycheck.

2. Entertainment needs (ideally 15%)

Since his work is intense and stressful, Tuan doesn’t want to ignore his entertainment needs. However, this category is also not a priority for him, so he will use up to 15% of his income for entertainment needs. At the end of the month, he will transfer whatever is left to his accumulation and investment fund.

3. Essential needs (ideally 50%)

Essential needs or fixed expenses include rent, electricity, water bills, petrol, and food. At the end of the month, whatever is left of this allocation will also be transferred into the accumulation and investment fund.

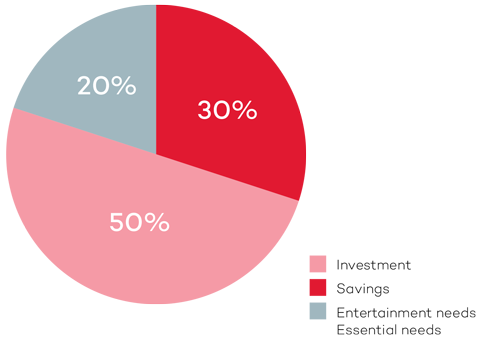

In order to achieve her new financial goals, and with an income of VND 7,000,000/month, Mai divides her spending list according to the new ratio as follows:

1. Investments - Savings (ideally 30%)

Of which 10% is for long-term savings and 20% for investment (10% for financial investment and 10% for personal development).

2. Entertainment, consumption needs (ideally 50%)

Because of her desire to discover new things, Mai has chosen to give this category a large percentage of her total income. Mai will spend this amount on entertainment for the month and save for traveling. Money to buy phones and computers is also included in this category.

3. Essential needs (ideally 20%)

As she lives with her family, Mai’s fixed monthly expenses only includes petrol, phone, snacks and gifts for friends and relatives. For Mai, 20% a month is enough for these essential expenses.